Infonetics Research has released highlights from its 2013 Small Cell Mobile Backhaul Equipment report, which tracks and forecasts outdoor small cell backhaul equipment revenue, units, connections and small cell sites by medium (copper, fiber, air).

See also: Analyst says enterprise small cell installations skyrocketing

“Outdoor small cells or, more accurately, low-power cells, are an exciting new expansion of mobile networking, but they come with challenging backhaul issues,” explains Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research. “As a result, deployments of outdoor small cells are modest right now, as mobile operators sort things out and test, trial and select technologies, products and vendors. But that’s about to change, and fast.”

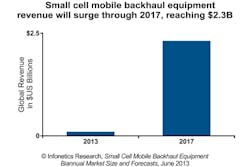

According to the report, the 2 main applications for outdoor small cell backhaul are adding capacity/extending coverage in high-traffic urban areas and adding coverage in rural areas. The nascent outdoor small cell mobile backhaul equipment revenue totaled $39 million worldwide in 2012. Richard Webb, directing analyst for microwave and carrier WiFi at Infonetics and co-author of the report adds, “We look for outdoor small cells to really kick into high gear beginning in 2014, and predict a cumulative $6 billion will be spent globally on outdoor small cell backhaul equipment between 2013 and 2017.”

More news: Report finds enterprise femtocell adoption growing

Infonetics projects that outdoor small cell backhaul connections will grow from fewer than 7,000 in 2012 to more than 850,000 in 2017. Of the small cell backhaul technologies, unlicensed millimeter wave makes up the largest portion of revenue. According to the data, North America currently leads the outdoor charge, with AT&T, Verizon, Sprint, Clearwire and Comcast investigating, planning and conducting field trial deployments. In its related Macrocell Mobile Backhaul Equipment and Services report, Infonetics predicts that a cumulative $44 billion will be spent on macrocell mobile backhaul equipment between 2013 and 2017.

Infonetics’ biannual small cell mobile backhaul equipment report tracks backhaul for mobile operator small cells located outdoors, such as those attached to light poles, utility poles, and the sides and tops of buildings. The report provides worldwide and regional market size, forecasts through 2017, and analysis for equipment, connections, and cell sites by type. Vendors tracked by the report include Actelis, Adtran, Alcatel-Lucent, Aviat, BlinQ Networks, BluWan, BridgeWave, Calix, Cambridge Broadband, Celtro, Ceragon, Ciena, Cisco, E-Band, ECI Telecom, Ericsson, Fastback, Fujitsu, Huawei, Juniper, MRV, NEC, Nokia Siemens Networks, Overture, Positron-Aktino, RAD Data, Radwin, Samsung, Siklu, Sub10 Systems, Taqua, Tarana, ZTE and many others. Learn more about the report.

More: Technical paper: Optimizing small cells and the HetNet