5 factors create the ‘perfect storm’ dragging down the data center infrastructure market

By Jason dePreaux, Director – Data Center and Critical Infrastructure Research, IHS

The underlying growth drivers of data centers seem as strong as ever. Attend any industry event or presentation and you will likely see the same references to big data, the Internet of Things, mobile, cloud, and online video all combining to form a rising tide of data that must be processed, distributed, and stored. In theory this should lift all boats involved with data centers. Unfortunately, on the infrastructure side, the uplifting wave of data is being overtaken by a perfect storm of negative factors.

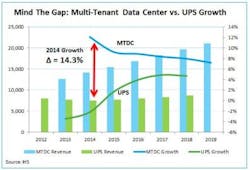

As an example to illustrate this divergence, let us consider two markets that IHS covers. The first is the multi-tenant data center industry, where customers rent space in which to locate their IT gear as opposed to housing it in their own facilities. This market has been incredibly buoyant over the past several years in averaging double-digit revenue growth. During the first half of 2014, IHS calculates that multi-tenant data center sales grew by 12.7 percent on a global basis—clearly a positive result from a market segment benefiting from many of the underlying growth drivers previously mentioned.

Compare the multi-tenant data center situation with that of uninterruptible power supplies (UPS). UPS systems are used to protect power delivery in mission-critical facilities like data centers. The UPS market recovered strongly following the great recession of 2008/09. However, it began to languish with nine consecutive quarters (and counting) of revenue decline versus the same period the previous year. Sales of related infrastructure, such as data center cooling systems, are also in a similar state of contraction. Even server shipments—the canary in the data center coal mine—are weak (most analyst firms are reporting while unit sales are up modestly, revenues are down).

How are we to reconcile the promising underlying growth drivers of data centers and the multi-tenant data center industry with the reality of the most challenging environment faced by infrastructure suppliers since the economic downturn?

IHS has identified five factors that have combined to create this “perfect storm.” Each of these factors is a massive topic on its own, and the goal of this piece is only to provide a short description relating to its impact on data center infrastructure.

- IT Improvements—IT gear continues to progress as time goes on. As the number of transistors per unit area increases (Moore’s Law), the amount of compute performed per Watt of electricity goes up. Along with more-efficient server power supplies, this means every generation brings users more bang for their buck at the hardware level. At the software level, the widespread adoption of virtualization allows for multiple virtual servers to run on a single machine, minimizing “zombie servers” that consume power while not performing work. IHS believes that these IT improvements are absorbing a significant amount of the data processing demand without the need for additional power and cooling infrastructure to be deployed.

- Economic Weakness—With the recession now several years behind us, economic prospects across much of the world remain muted. IHS economists have recently tempered down its global GDP growth projections in 2015 and 2016 to 3.2 and 3.6 percent, respectively. Economic uncertainty weighs heavily on capital-intensive ventures like data centers, as organizations prefer to wait and see what the future brings before making outlays.

- Outsourcing and Consolidation—IHS believes that the migration from enterprise-owned data centers to multi-tenant data centers or cloud providers is having a damping effect on the need for additional power and cooling infrastructure. Multi-tenant data centers tend to be large in scale and built with highly efficient designs to more fully optimize the power and cooling infrastructure when compared to enterprise-owned facilities. Whatever the outsourcing strategy, nearly all major companies have implemented or are implementing consolidation programs to centralize fragmented computing resources into fewer and larger facilities.

- Competitive Pressure—With the available pie shrinking, it is normal for competitive pressures to bring down pricing, which further drags on revenue. Historically, UPS and related products had been resistant to price erosion as labor costs and commodity increases were passed along. However, there is now reason to believe that the challenging market environment has caused price reductions to win bids—especially as vendors look to attract more lucrative after-sales service agreements to the equipment when out of warranty.

- Disruptive Data Center Designs—This is perhaps the most interesting and difficult factor to assess. Clearly there is a massive change in traditional data center architecture on the part of “hyperscale” data center operators whose core businesses lie in their data centers (think Google, Facebook, Amazon). Some designs eschew traditional infrastructure like UPS and cooling systems in favor of more radical and power-saving methods. Without a doubt, free-air cooling is becoming more accepted. In addition, there seems to be an overall reduction in the level of UPS redundancy deployed in new builds to minimize capital and operational expenditures. The Open Compute initiative seeks to bring some of these innovations to wider audiences. The trick-down of these disruptive data center forces will be one of the most important aspects to watch over the next 5 to 10 years.

IHS believes that these five factors have a range of weighting and will play out differently in the coming years. On one hand, certain factors are more transitory as in the case of IT improvements. VMware suggest that between 40 percent and 60 percent of mission-critical servers are currently virtualized, so at some point the market will reach “peak virtualization.” On the other hand, some disruptive data center designs may take many years to become widely accepted in the risk-averse and conservative data center industry. I’m willing to bet that five years from now, not every enterprise will be ODMing its own servers with batteries attached a la Google. Either way, we are clearly living in interesting times in the data center industry.

Jason dePreaux (bio) directs IHS’s data center and critical infrastructure research.