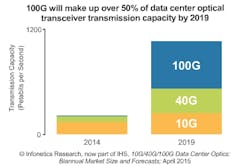

Analyst: 40G transceivers ubiquitous, 100G accelerating in data center optics market

May 18, 2015

Sponsored Recommendations

Sponsored Recommendations

Adapt to higher fiber counts

May 29, 2024

Going the Distance with Copper

May 29, 2024