BSRIA additionally found that most of the large converged intelligent buildings are new-build or major refurbishments in verticals like retail/shopping centers, high-end offices, universities, hospitals, airports, sports stadiums, government buildings, hotels and luxury departments.

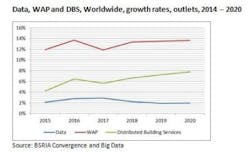

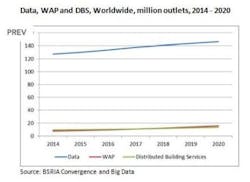

Lone Hansen, worldwide market intelligence manager for BSRIA’s IT Cable Group, said, “The impact of convergence on the structured cabling market will continue to be limited as the growth in WAPs and DBS is coming from a small base. The main factor that could boost the market is the performance of solutions for the retrofit market. Most of the buildings in the UK and western world date from before 1990, and only 15 to 20 percent have been built since 1990. An estimated 20 to 25 percent of non-residential buildings in the western world have a sophisticated enterprise management system.

“Most buildings have local area networks, although the standard and quality will vary and the option of adding new products and services to existing networks are limited. The uptake of IP products has increased—particularly for BACS, CCTV and access controls. However, many of these solutions are installed as standalone solutions, and are not converged. This is partly due to the silos in the construction industry, which each area generally tender separately, which leads to a lack of holistic thinking.”

Find out more about BSRIA’s Worldwide Market Intelligence offerings here.