Infonetics Research recently released its 2014 Carrier WiFi Strategies and Vendor Leadership: Global Service Provider Survey, which explores the drivers, strategies, models, and technology choices that are shaping service provider WiFi deployments. The market research firm finds that Carrier WiFi deployments are evolving to deliver the same quality of experience as mobile and fixed-line broadband service environments -- and that this evolution is driving WiFi networks to become more closely integrated.

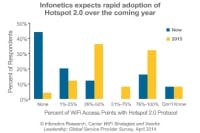

Further, Infonetics says that Hotspot 2.0, a key tool developed by the industry to aid this integration, shows rapid adoption by carriers participating in the survey. The firm estimates that service provider respondents to its Carrier WiFi survey have an average of 32,000 access points currently, growing to just over 44,000 by 2015, representing 33% growth over the next year. 40% of Infonetics’ operator respondents said they expect to integrate Hotspot 2.0 into more than half their access points by the end of 2015.

“Operators are betting pretty big on Carrier WiFi, but they’re also keen to develop ways of monetizing services so that WiFi starts to pay for itself over the coming years," adds Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research. "WiFi roaming and location-based services are examples of customer plans that are growing fast.”

Related: Report forecasts $8.5B to be spent on Carrier Wi-Fi equipment over next 5 years

Among those surveyed, the top 3 monetization models for WiFi services are pre-pay, bundled with mobile broadband subscription, and tiered hotspots. Respondents perceived Cisco and Ruckus Wireless as the top carrier WiFi manufacturers for second consecutive year. Notably, WiFi as a separate overlay network currently leads the list of technologies and architectures for offloading data traffic. Meanwhile, the survey sees more sophisticated Carrier WiFi architectures gaining gradual traction, as respondents look to bring WiFi into the mobile RAN via SIM-based service models or by deploying dual-mode WiFi/small cells.

For its 43-page WiFi strategies survey, Infonetics interviewed independent wireless, incumbent, competitive, and cable operators in Europe, Asia Pacific, the Middle East and Africa, North America, and Latin America that that have deployed WiFi in the public domain (or will soon). The report provides insights into carrier WiFi deployment drivers and locations; access point standards, form factors, features, ranges, and backhaul connections; hotspots; mobile data offload; service delivery models and challenges; customer plans; and opinions of WiFi equipment manufacturers.

Vendors named in the survey include Alcatel-Lucent, Aruba Networks, Cisco, Ericsson/BelAir, Guoren, HP, Huawei, Motorola, NSN, Ruckus Wireless, Zhidakang, Xirrus, ZTE, and others. Learn more about the survey.