BSRIA: Category 6A Will Outsell Category 6 for the First Time This Year

In a series of newly published market intelligence reports, BSRIA tracks the market size of structured cabling systems through the year 2023 and forecasts growth or decline through 2028. BSRIA provides in-depth information on the following 16 countries, each of which is detailed in an individual report.

- Brazil

- Canada

- China

- France

- Germany

- India

- Japan

- Mexico

- Netherlands

- Norway

- Poland

- Saudi Arabia

- Spain

- United Arab Emirates

- United Kingdom

- United States

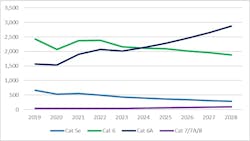

When summarizing the findings of its global market examination, BSRIA stated the current year, 2024, will be the year in which Category 6A channels outsell Category 6 channels for the first time. This statement affirms the forecast BSRIA made in 2020 that Cat 6A would outsell Cat 6 in 2024. The graph on this page, provided by BSRIA, shows the growth or decline rates of Category 5e, Category 6, Category 6A, and Category 7/7A/8 channels for the decade from 2019 through 2028.

Lone Hansen, senior manager within BSRIA’s worldwide market intelligence division, has analyzed the world’s structured cabling markets for more than 20 years. She pointed out these figures represent full-channel sales. That is relevant because if higher-performing cable is terminated with lower-performing connectivity, the full channel is recognized as the lower-performing level. Hansen says this fact plays a role in the small, nearly flat line for Category 7/7A/8 cabling. “A large proportion in DACH [Germany, Austria, Switzerland], particularly Germany, are solutions using Cat 6A connectivity with Cat 7/7A/8 cables,” she pointed out. So sales of Category 7/7A/8 cables are more robust, particularly in the DACH region, than the graphed line may suggest.

Beyond 2024, the gap between Category 6 and Category 6A channel deployments will widen, as Cat 6A is growing while Cat 6 remains on the decline. Both types declined in 2023 after growing the two previous years. BSRIA explained that several factors contributed to 2023’s decline, a predominant one being overstocking that occurred in 2022 resulting in high inventory levels, and therefore low demand, in 2023.

When the world market is viewed from a standpoint of volume shipments (cable footage, connectivity units) rather than monetary growth or decline (money spent), in 2023 some countries matched their 2019 (pre-Covid) volumes but many have not. Where 2023 spending levels exceed 2019 spending levels in many countries, the growth is due primarily to price increases coupled with higher-performing cabling systems being purchased.

BSRIA’s series of reports “World Market for Structured Cabling 2024/R2023” provides information on market size, historic data, and forecasts sales by suppliers segmented by product type (data center vs. LAN, copper and fiber, cable and connectivity, categories, connectivity type). The reports, available in PDF and Excel format, also include summaries with key numbers and trends, an overview of the top 12 suppliers by product area and region. You can find more information on these reports here.

About the Author

Patrick McLaughlin

Chief Editor

Patrick McLaughlin, chief editor of Cabling Installation & Maintenance, has covered the cabling industry for more than 20 years. He has authored hundreds of articles on technical and business topics related to the specification, design, installation, and management of information communications technology systems. McLaughlin has presented at live in-person and online events, and he has spearheaded cablinginstall.com's webcast seminar programs for 15 years.