According to results published on Dec. 6 in the International Data Corporation (IDC) Worldwide Quarterly Ethernet Switch Tracker and Worldwide Quarterly Router Tracker reports, the global Ethernet switch market (Layer 2/3) recorded $7.32 billion in revenue in the third quarter of 2019 (3Q19), an increase of 0.1% year over year. Meanwhile, worldwide total enterprise and service provider (SP) router market revenues grew 0.8% year over year in 3Q19 to $3.74 billion.

Per IDC, from a geographic perspective, the 3Q19 Ethernet switch market delivered mixed results across the globe. The Middle East and Africa region reportedly grew 9.3% with the region's largest market, the United Arab Emirates, growing 6.9% year over year while Israel's market grew 18.8%. Across Europe, growth was stagnant. The Central and Eastern Europe (CEE) region lost 9.0% compared to a year earlier with Russia dropping 13.9% year over year. The Western Europe market fell 6.1% with Germany losing 5.6% year over year. Denmark was a bright spot in the region with 18.6% year-over-year growth.

The Asia/Pacific (excluding Japan) (APeJ) region grew 1.3% year over year. In China, the market grew 4.6% year over year while the Philippines rose 25.9%. Japan was off 3.8% compared to its growth in 3Q18. In Latin America, the market dropped 4.4% year over year, while the U.S. market grew 2.6% annually and Canada declined 4.9% year over year.

"The over-arching trend driving both the Ethernet switch and router markets continues to be enterprise, communications service provider, and cloud SP investments in agile cloud connectivity to meet the needs of their business and customers," said Rohit Mehra, vice president, Network Infrastructure, at IDC. "The demand for higher speeds across a range of network connectivity options will spur growth in these markets in the coming years as bandwidth needs increase and mission-critical applications demand even lower latencies."

Growth in the Ethernet switch market continues to be driven by the highest-speed switching platforms, finds the analyst. For example, port shipments for 100Gb switches rose 57.2% year over year to 5.6 million. 100Gb revenues grew 32.8% year over year in 3Q19 to $1.44 billion, making up 19.6% of total market revenue compared to 14.8% a year earlier. 25Gb switches also saw impressive growth with revenues increasing 69.3% to $463.4 million and port shipments growing 68.0% year over year. Lower-speed campus switches, a more mature part of the market, saw moderate growth in port shipments but declining revenue, pointing to a decrease in average selling prices (ASPs). 10Gb port shipments rose 7.9% year over year, but revenue declined 8.7% to deliver 26.3% of total market revenue. 1Gb switches grew 3.9% year over year in port shipments but declined 7.4% in revenue. 1Gb now accounts for 39.2% of the total Ethernet switch market revenue.

Meanwhile, for its part, according to IDC, the worldwide enterprise and service provider router market increased 0.8% on a year-over-year basis in 3Q19 with the major service provider segment, which accounts for 75.5% of revenues, decreasing 0.1% and the enterprise segment of the market growing 3.6%.

From a regional perspective, the combined service provider and enterprise router market fell 1.5% in APeJ with the enterprise segment growing 1.5% and the service provider segment declining 2.2% year over year. Japan's total market grew 3.9% year over year. Revenues in Western Europe were off 7.3% year over year while CEE revenues for the combined enterprise and service provider market grew 3.5% year over year. The Middle East & Africa region was up 8.9%.

In the U.S., the enterprise segment was up 7.3% while service provider revenues grew 1.8%, giving the combined markets 3.2% year-over-year growth. In Latin America, the market grew 11.7%.

"Dynamics in the Ethernet switch and routing markets continue to evolve," commented Petr Jirovsky, research director, IDC Networking Trackers. "In Ethernet switching, the seemingly insatiable demand for higher-speed networking platforms continue to drive investments. Meanwhile, lower-speed campus switching continues to moderate as enterprises build out connectivity platforms to support mobile workers and the Internet of Things. In the routing segment, the enterprise continues to buoy the broader market as enterprises and service providers augment their networks to support improved cloud connectivity."

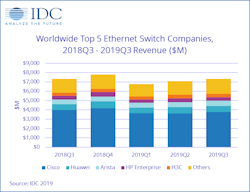

According to IDC, company highlights for the analyzed market segments include the following:

-- "Cisco finished 3Q19 with a 5.6% year-over-year decline in overall Ethernet switch revenues and market share of 51.3%. In the hotly contested 25Gb/100Gb segment, Cisco was the market leader with 38.2% revenue share. Cisco's combined service provider and enterprise router revenue declined 10.6% year over year with enterprise router revenue increasing 3.4% and SP revenues falling 18.1%. Cisco's combined SP and enterprise router market share increased to 37.9%, up from 36.8% in 2Q19."

-- "Huawei's Ethernet switch revenue rose 4.4% on an annualized basis, giving the company market share of 8.9%. The company's combined SP and enterprise router revenue rose 20.6% year over year, giving the company a market share of 28.1%."

-- "Arista Networks saw Ethernet switch revenues increase 14.3% in 3Q19, bringing its share to 7.6% of the total market, up from 6.6% a year earlier. 100Gb revenues accounting for 68.8% of the company's total revenue, indicating the company's focus on hyperscale and cloud providers."

-- "HPE's Ethernet switch revenue declined 7.0% year over year, resulting in overall market share of 5.3%."

-- "Juniper's Ethernet switch revenue rose 4.5% year over year in 3Q19, bringing its market share to 3.2%. Juniper saw a 17.9% decline in combined enterprise and SP router sales, bringing its market share in the router market to 10.9%."

IDC says its Worldwide Quarterly Ethernet Switch Tracker and Worldwide Quarterly Router Tracker reports provide total market size and vendor shares for the Ethernet switch and router technologies in an easy-to-use Excel pivot table format. The geographic coverage for both the Ethernet switch market and the router market includes eight major regions (USA, Canada, Latin America, Asia/Pacific (excluding Japan), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries.

The Ethernet switch market is further segmented by speed (100Mb, 1000Mb, 10Gb, 25Gb, 40Gb, 50Gb, 100Gb), product (fixed managed, fixed unmanaged, modular), and layer (L2, L3, ADC). Measurement for the Ethernet switch market is provided in vendor revenue, value, and port shipments. The router market is further split by product (high-end, mid-range, low-end, SOHO), deployment (service provider, enterprise), connectivity (core, edge), and the measurements are in vendor revenue, value, and unit shipments.

To learn more, visit www.idc.com.