Analyst firm predicts 26 percent CAGR through 2019.

By Patrick McLaughlin

Just about one year ago analyst firm IHS (www.ihs.com) issued the report “DCIM Report - 2014,” which defines what it calls the “DCIM suite,” identifies vendors offering them, and estimates the global market for data center infrastructure management (DCIM) for the years 2014-2019. At the time IHS projected the 2014 market to reach $280 million and to grow 30.6 percent in 2015.

When issuing the report, the company stated, “IHS defines ‘DCIM suite’ offerings as those that interact with three or more functional areas of the data center-power, cooling, space/environment, cabling, networking and connectivity, and servers and storage.”

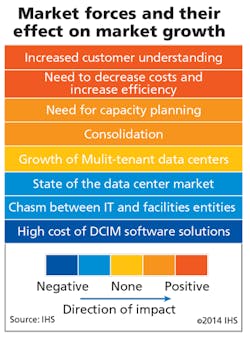

In addition to its 30.6-percent growth projected for 2015, IHS forecast an overall compound annual growth rate (CAGR) or 26 percent for the full study period 2014-2019, “based on balancing the influence of a number of drivers and inhibitors,” the firm said.

The firm spelled out the drivers and inhibitors in text and graphical form; we’ve reproduced the graphic in this article. Following is IHS’s listing and explanations of those factors, described in order of their positive (driver) to negative (inhibitor) impact on the DCIM market.

Increased Customer Understanding-Customers are increasingly aware of what DCIM is and the benefits it provides, which makes it easier for suppliers to sell these solutions. Beyond that, IHS believes this will also lead to a decrease in the amount of DCIM software that is given away as a free trial or at discounted rates [which are] practices that inhibit revenue growth in the short term.

Decreasing Costs and Increasing Efficiencies-This is certainly a driver of DCIM market growth to some degree. Vendors are providing case studies proving that DCIM, when used to its fullest potential, can help data center managers decrease costs associated with running a data center and increase efficiencies in the user of power, space, cooling, and IT equipment. This growth driver does come with the caveat that it is more applicable to existing data centers than newly built data centers, which tend to incorporate the latest technologies and facility design, making efficiency inherent.

Capacity Planning-Data center managers are motivated to use available space, power and compute capacity as efficiently as possible, so the capacity planning components offered in DCIM suites make this a driver of DCIM adoption in many cases.

Consolidation-Consolidation continues to be a key strategy for reducing data center costs, and the change management, capacity planning, and workflow components of DCIM software can be very helpful in consolidation situations, making this one ore motivation for adoption.

Multi-Tenant Data Centers-A number of DCIM offerings have features designed specifically for use in multi-tenant environments, which provides additional motivation for this fast-growing sector of the market to adopt DCIM. However, many multi-tenant data center operators offer their own proprietary DCIM products to their customers.

State of the Data Center Market-Certain segments of the data center market are growing substantially (e.g., multi-tenant data centers), but the market as a whole is not doing as well as one might think. One factor dampening growth is the more efficient use of space and compute. Many DCIM software offerings are priced based on number of racks, number of devices, or number of MW that the customer wishes to monitor, and because of this, the same efficiencies that are dampening data center market growth are likely inhibiting DCIM suite revenue growth to some degree as well.

Chasm Between IT and Facilities-The fact that IT management and facilities management are traditionally siloed creates a compelling argument for adopting a DCIM suite, because these solutions unit management of both areas into one dashboard and reporting software. However, this same problem also makes choosing and purchasing a solution much more difficult and often inhibits the adoption of DCIM.

High Cost of DCIM Suite Solutions-The high cost of the software license and associated service fees has been a barrier to adoption, especially in cases where customers are not convinced of the return on investment.

Since the time of that study, at least one boardroom-level transaction suggests a willingness to go “all in” on DCIM. In September Legrand (www.legrand.com) completed the acquisition of certain assets of Raritan’s business, including intelligent power and KVM products. Raritan retained its DCIM business and spun it off as Sunbird Software (www.sunbirddcim.com).

Sunbird describes itself as “an independent pure-play software company [that] will focus on growing its leadership position in the DCIM field, accelerating software development, and helping customers create and manage agile and efficient data centers.”

The company’s chairman, Ching I-Hsu, commented at the time of the spinoff, “Sunbird Software will build on our seven years of success to advance DCIM, helping customers use data center resources more efficiently.”

Patrick McLaughlin is our chief editor.