Analyst: Bare metal switches gaining in data center

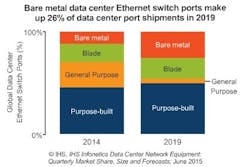

Sales of bare metal switches, also known as "white box" switches, grew 11% year-over-year in the first three months of 2015, and accounted for 12% of all data center Ethernet ports shipped worldwide during the quarter, according to the newly released IHS-Infonetics "Data Center Network Equipment" report from market research firm IHS (NYSE: IHS).

The open network elements were one of the brighter spots within the data center network equipment market in 1Q15. Overall, sales of such equipment, which includes data center Ethernet switches, application delivery controllers (ADCs), and WAN optimization appliances (WOAs), shrank 14% sequentially to $2.6 billion, but grew 4% versus the year-ago quarter, reports the analyst.

As the chart above illustrates, IHS expects the open networking trend to continue to leave its mark on data center equipment sales. "Open networking, which leverages open source software and open hardware designs and allows anyone to innovate, is set to change networking, just as open source changed the server and OS marketplace," asserts Cliff Grossner, Ph.D., research director for data center, cloud, and SDN at IHS.

"This move to open networking is heightening the importance of bare metal switches, as evidenced by all the vendor announcements at Interop in April," Grossner continues. "Dell is expanding its open networking portfolio with three new branded bare metal switches providing options from 1G to 100G Ethernet. And Citrix entered the SD-WAN market with Cloudbridge Virtual WAN Edition, which allows enterprises to create a virtualized WAN."

The quarterly IHS Infonetics "Data Center Network Equipment" report tracks data center Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs), and WAN optimization appliances (WOA). The research service provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis, and trends.