Infonetics Research has released vendor market share and analysis highlights from its 4th quarter (4Q13) and year-end Ethernet Switches report.

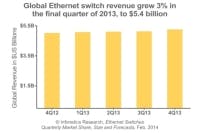

According to the report, worldwide Ethernet switch revenue continued to grow in 4Q13, up 3% from 3Q13, to $5.4 billion; more importantly, the market remained positive (+3%) on a year-over-year basis. The analysis finds that that, in general, buyers are shifting their purchases toward switches with advanced capabilities such as management features, Power over Ethernet, and higher speeds, to deal with the increasing demands that applications are placing on network infrastructure.

“2013 was a bumpy year for the Ethernet switch market, but in the end, revenue set another record and passed the $20 billion mark," reveals Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research. "While 10G was once again the key growth driver, we’re finally seeing this segment mature after a decade, and 40G is now taking over as the new high-growth segment."

The research also finds that 100G ports shipments once again doubled quarter-over-quarter, and Infonetics expects the 100G market to gain critical mass in 2015.

Globally, North America and China were the top-performing geographies in Ethernet switch sales in 2013. In terms of top vendors, Huawei’s Ethernet switch revenue soared 80% sequentially in 4Q13, propelling the vendor into the #4 spot behind Cisco, HP, and Juniper, according to the data.

Infonetics' Machowinski concludes, “40G alone will easily pass $1 billion in revenue this year as it becomes the technology of choice in the data center.”

Learn more about the report.