5 factors create the ‘perfect storm’ dragging down the data center infrastructure market

Nov. 10, 2014

Sponsored Recommendations

Sponsored Recommendations

March 28, 2025

March 28, 2025

The underlying growth drivers of data centers seem as strong as ever. Attend any industry event or presentation and you will likely see the same references to big data, the Internet of Things, mobile, cloud, and online video all combining to form a rising tide of data that must be processed, distributed, and stored. In theory this should lift all boats involved with data centers. Unfortunately, on the infrastructure side, the uplifting wave of data is being overtaken by a perfect storm of negative factors.

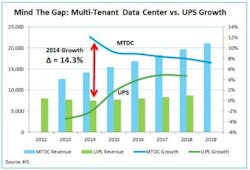

As an example to illustrate this divergence, let us consider two markets that IHS covers. The first is the multi-tenant data center industry, where customers rent space in which to locate their IT gear as opposed to housing it in their own facilities. This market has been incredibly buoyant over the past several years in averaging double-digit revenue growth. During the first half of 2014, IHS calculates that multi-tenant data center sales grew by 12.7 percent on a global basis—clearly a positive result from a market segment benefiting from many of the underlying growth drivers previously mentioned.

Compare the multi-tenant data center situation with that of uninterruptible power supplies (UPS). UPS systems are used to protect power delivery in mission-critical facilities like data centers. The UPS market recovered strongly following the great recession of 2008/09. However, it began to languish with nine consecutive quarters (and counting) of revenue decline versus the same period the previous year. Sales of related infrastructure, such as data center cooling systems, are also in a similar state of contraction. Even server shipments—the canary in the data center coal mine—are weak (most analyst firms are reporting while unit sales are up modestly, revenues are down).

How are we to reconcile the promising underlying growth drivers of data centers and the multi-tenant data center industry with the reality of the most challenging environment faced by infrastructure suppliers since the economic downturn?

IHS has identified five factors that have combined to create this “perfect storm.” Each of these factors is a massive topic on its own, and the goal of this piece is only to provide a short description relating to its impact on data center infrastructure.

IHS believes that these five factors have a range of weighting and will play out differently in the coming years. On one hand, certain factors are more transitory as in the case of IT improvements. VMware suggest that between 40 percent and 60 percent of mission-critical servers are currently virtualized, so at some point the market will reach “peak virtualization.” On the other hand, some disruptive data center designs may take many years to become widely accepted in the risk-averse and conservative data center industry. I’m willing to bet that five years from now, not every enterprise will be ODMing its own servers with batteries attached a la Google. Either way, we are clearly living in interesting times in the data center industry.

Jason dePreaux (bio) directs IHS’s data center and critical infrastructure research.