IDC: Ethernet switch market grew 8.1%, router market declined 5.1% YoY in 3Q18

According to technology market analyst International Data Corporation (IDC), the worldwide Ethernet switch market (Layer 2/3) recorded $7.3 billion in revenue in the third quarter of 2018 (3Q18), an increase of 8.1% year over year. Meanwhile, total enterprise and service provider (SP) router market revenues declined 5.1% year over year in 3Q18 to $3.7 billion. The data was published today in the IDCQuarterly Ethernet Switch Tracker and IDC Quarterly Router Trackerreports.

Ethernet Switch Market Highlights

According to the analyst, from a geographic perspective, the 3Q18 Ethernet switch market had a strong quarter across the globe. The Asia/Pacific (excluding Japan) (APeJ) region grew 15.8% year over year. Within the region, Indonesia had notable growth of 40.2% year over year, while Taiwan's market grew 27.8%. The region's largest market, the People's Republic of China, grew 15.8% while Japan's Ethernet switch market rose 4.0%.

Within the Europe, Middle East and Africa (EMEA) region, the Middle East and Africa (MEA) saw year-over-year growth of 7.8%. Qatar's switch market was up 33.0% while Egypt's market also grew 33.0%. Turkey's market fell 22.5%. In Central and Eastern Europe, growth came in at 10.7%. Romania had a strong quarter, growing 48.8% while Russia's market was up 26.5%. Western Europe grew 7.3% year over year, with Portugal showing strong growth of 52.2% and Finland growing 25.6%.

Ethernet Alliance 'Higher Speed Networking Plugfest' set for next month

Latin America was the one region in the world that saw a year-over-year decline, ending the quarter down 4.5%. Mexico, the region's largest market, grew 6.5% but that was offset by Argentina's 10.9% decline and Colombia's drop of 13.5%. The Ethernet switch market in the United States rose 5.9% while Canada's market grew 6.0%.

"Digital Transformation and adoption of Third Platform technologies continue to drive demand for network transformation and in turn the Ethernet switching equipment market," said Rohit Mehra, vice president, Network Infrastructure, at IDC. "While hyperscalers and cloud service providers are pushing consumption at the high end of the switching market, there remains strong growth in the enterprise campus and lower speed switching platforms too, highlighting the increased demands of the network from organizations of all sizes."

According to IDC, 100Gb Ethernet switch revenues continue to grow rapidly. Port shipments for 100Gb switches rose 154.6% year over year to 3.5 million. 100Gb revenues broke the $1 billion barrier in 3Q18, reaching $1.1 billion to make up 14.8% of the market's total revenue. 25Gb ports saw even higher growth rates with port shipments up 251.0% to 2.6 million and revenue increasing 219.6% year over year for 3.7% of the market's revenue.

40Gb port shipments rose too, growing 12.6% year over year to 1.3 million, while revenues declined 10.4% for 7.5% of the market's total. Lower-speed campus switches continued to see strong demand. 10Gb port shipments rose 16.0% year over year to make up 28.8% of the market's revenue. 1Gb switches saw port shipments grow 8.4% year over year to 116.4 million, representing 42.3% of the market's total revenues.

Router Market Highlights

Per the new data from IDC, the worldwide enterprise and service provider router market fell by 5.1% on a year-over-year basis in 3Q18 with the major service provider segment, which accounts for 76.2% of revenues, declining by 7.3%. Meanwhile, the enterprise portion of the router market grew 2.5% year over year.

From a regional perspective, the combined service provider and enterprise router market declined 24.4% in the U.S., where service provider revenues dropped 31.5% while enterprise revenues grew 8.7%. The Asian markets were mixed in 3Q18: The APeJ region increased 7.6% year over year, but Japan's market dropped 20.0% on an annualized basis. Central and Eastern Europe saw healthy 13.3% year over year growth across the service provider and enterprise segments, while Western Europe's market rose 4.3%. The Middle East and Africa region was up 8.4%, but the Latin American market dropped 2.3% year over year.

Vendor highlights for each market, according to the analyst, include the following:

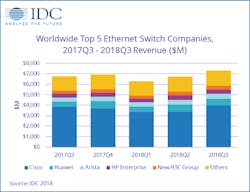

Cisco finished 3Q18 with a 3.8% year-over-year increase in overall Ethernet switch revenues and market share of 54.4%. In the hotly contested 25Gb/50Gb/100Gb segment, Cisco is the market leader with 39.4% revenue, which is up from the 34.6% share it held in this segment in the previous quarter. Cisco's combined service provider and enterprise router revenue declined 2.2% year over year, with enterprise router revenue increasing 4.1% but service provider revenues declining 5.3%. Cisco's combined service provider and enterprise router market share increased to 42.7% from 35.7% last quarter.

Huawei's Ethernet switch revenue rose 21.3% on an annualized basis but was down 7.5% sequentially from 2Q18 to 3Q18 with market share of 8.6%. The company's combined service provider and enterprise router revenue rose 2.2% year over year with a market share of 23.5%.

Arista Networks saw Ethernet switch revenues increase 27.6% in 3Q18, bringing its share to 6.6% of the total market, up from 5.6% a year earlier. With its focus on the datacenter, the company continues to cater to the higher end of Ethernet switch speeds with 100Gb revenues accounting for 66.1% of the company's total revenue, indicating the company's focus on cloud providers and large enterprises.

HPE's Ethernet switch revenue grew 12.0% year over year but was off 4.9% sequentially. The company's market share rose to 5.7%, up from 5.5% a year earlier.

Juniper's Ethernet switch revenue grew 3.8% in 3Q19, bringing its market share to 3.0%.Juniper saw a 15.2% decline in combined enterprise and service provider router sales, bringing its market share in the router market to 13.4%.

CommScope opens Power over Ethernet R&D lab

"The Ethernet switch market remains strong across the globe, with both mature and emerging markets looking to capitalize on the benefits that higher-speed switching platforms and advanced automation tools enable," said Petr Jirovsky, research manager, IDC Networking Trackers. "This creates a competitive market for enterprises to choose from a variety of products and creates strong opportunity for vendors to help customers in their network transformation journeys."

The IDC Quarterly Ethernet Switch Tracker and the IDC Quarterly Router Tracker provide total market size and vendor shares for the Ethernet switch and router technologies in an easy-to-use Excel pivot table format. The geographic coverage for both the Ethernet switch market and the router market includes eight major regions (USA, Canada, Latin America, Asia/Pacific (excluding Japan), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries.

The Ethernet switch market is further segmented by speed (100Mb, 1000Mb, 10Gb, 25Gb, 40Gb, 50Gb, 100Gb), product (fixed managed, fixed unmanaged, modular), and layer (L2, L3, ADC). Measurement for the Ethernet switch market is provided in vendor revenue, value, and port shipments. The router market is further split by product (high-end, mid-range, low-end, SOHO), deployment (service provider, enterprise), connectivity (core, edge), and the measurements are in vendor revenue, value, and unit shipments.

To learn more, visit www.idc.com.