How technical and business issues are steering the ICT industry into 2020

By Patrick McLaughlin

As the “twenty-teens” become the “twenty-twenties,” the information and communications technology (ICT) industry is in a familiar place—on the precipice of change. Technical, cultural, political, and business forces combine to drive change in the ways people, organizations, and devices communicate with each other. These changes force evolution in the infrastructure supporting that communication, of which the ICT industry is a vital cog.

On a daily basis, professionals in the ICT industry must look beyond buzzwords to make conscientious decisions that have long-term implications on communications systems of today and tomorrow. In an effort to understand the issues that are most significantly affecting these decisions, we conducted a survey in fall 2019 that collected input from professionals across the ICT industry. We asked each survey participant to identify the organization for which they work as one of the following: design and/or installation contracting organization; manufacturer or distributor of cabling products and systems; owner/end-user of installed cabling systems; consultant to end-user organizations. Their answer to this question determined the remaining questions we posed to them. We asked many of the same questions to contractors and consultants, while end-users and manufacturers/distributors had distinct sets of questions. A total of 787 professionals from across these organization types participated.

This numbers-intensive and data-heavy article summarizes a number of the survey results, in some cases comparing and contrasting how different respondent types answered questions about similar topics.

Contractor concerns

In our survey of design and installation contractors, we asked about their business revenues compared to one year ago. On the whole the response was positive. Just about half—49%—said their revenues have increased by up to 20% over last year. Specifically, 15% said their revenues are up 1 to 5%, and 34% said it is up between 6 and 20%. Another 16% report business being up between 21 and 50%.

Some aren’t faring as well; 10% report their revenues are down 1 to 5% and another 8% report it being down 6 to 20%.

One cultural issue that can—and evidently does—directly impact the ICT industry is the so-called “talent crunch.” Management consulting firm Korn Ferry, which authored a report titled “The Global Talent Crunch,” explained, “By 2030, demand for skilled workers will outstrip supply, resulting in a global talent shortage of more than 85.2 million people. Signs are already emerging that within two years there won’t be enough talent to go around.”

As we’re ready to turn the calendar to 2020, feedback from your peers and colleagues indicates the crunch is real. We asked contracting organizations to consider the previous 12 months, and to characterize their ability to find and hire technically qualified employees in that time. Thirty percent indicated they have not needed and/or not had the opportunity to hire in that timeframe. Putting that 30% aside, and focusing on the remaining contractors who were in a position to hire over the previous year, 42% of them said they had some difficulty finding and hiring technically qualified employees, and 27% said they had significant difficulty doing so.

Remote powering

Getting into the technicalities of designing and installing ICT infrastructure systems, we asked contractors, “In addition to installing passive cabling systems, which of the following network devices do you specify and/or install for your end-user customers?” Here are their responses.

- Surveillance cameras: 81%

- Switches, including Power over Ethernet powering sources: 75%

- Access-control systems: 62%

- Alarm systems: 39%

- Building automation systems: 32%

- Traditional AC lighting systems: 21%

- PoE lighting systems: 20%

The installation of cables that will be used to support remote powering including PoE became a precarious activity in 2019, when legislative initiatives in several states sought to require an electrician’s license in order to install such cables that were destined to carry power above certain wattages. In our June 2019 issue I reported on two bills introduced in Texas (SB 1004 and HB 1141), that would have defined any cabling circuit supplying more than 50 watts of power to be electrical work, and require an electrician’s license to install.

In November, Belden’s technology and application manager for LAN, Ron Tellas, wrote in a blog post that in 2019 the National Systems Contractors Association (NSCA) monitored more than 130 bills across at least 35 states that related to the installation of cables for remote powering. In his post, titled, “Installing PoE cable; why we all should pay attention to state legislation,” Tellas cited 2019 legislative proposals in Arizona, Hawaii, Idaho, Maryland, North Dakota, New York, and Texas.

“In simple terms, much of this proposed legislation would require an electrical license to plug in PoE ports or pull and install PoE cable,” Tellas explained. “An extreme case in Pennsylvania had proposed legislation on the table that would’ve required a licensed electrician to install any cabling carrying more than 10 volts. Imagine the impacts this would have on low-voltage installers. It would make it nearly impossible for you to do install or integrate any technology that requires pulling to install PoE cable—unless you first become licensed electricians in each state you do work.”

Tellas’s blog post refers to a report by Commercial Integrator editorial director Jonathan Blackwood, in which Blackwood describes how representatives of the NSCA and Cisco Systems went state-by-state this year addressing these proposed legislative changes. Blackwood reports, “In the end, Cisco and NSCA were able to fight the legislation so that there was either no effect or an actual gain in the benefit to integrators in terms of pulling PoE cabling.” Blackwood concludes by saying, “Thanks to Cisco and the NSCA your technicians aren’t required to go get electrician’s licenses.”

Belden’s Tellas explains that in October, he attended the inaugural Connected Technology Industry Legislative Summit, which took place in Indiana. The PoE-cabling-related bills that were proposed in many states were a focal point of the summit. The event brought together professionals from associations including the NSCA, CEDIA (Custom Electronics Design and Installation Association), Building Industry Consulting Services International (BICSI), the Communications Cable and Connectivity Association (CCCA), the Continental Automated Buildings Association (CABA), the Electronic Security Association (ESA), the Security Industry Association (SIA), and the Telecommunications Industry Association (TIA).

“During the Connected Technology Industry Legislative Summit, we discussed the industry’s need for a new O*NET occupational code assignment for low-voltage installers,” Tellas said. “The actual term is yet to be agreed on. This would unify data-cabling installers in all industry segments under one name with like training and job responsibilities. This information is managed by the U.S. Office of Management and Budget for use in collecting statistical information on occupations.”

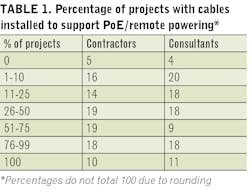

With our survey results showing 95% of contractors installing PoE/remote-power cabling, this legislative activity, the efforts of organizations like NSCA and Cisco, as well as initiatives like the Connected Technology Industry Legislative Summit are vital.

Technologies providing opportunities

The evolution of Internet Protocol (IP)-based audio-visual (AV) technologies has brought AV into the portfolio of increasing numbers of ICT contractors. With that in mind, we asked our survey respondents to consider the past two years of business and tell us, within that two-year timeframe, the percentage of their projects that have included AV systems. Eighty-seven percent have designed and/or installed at least some (more than 0%) AV systems within two years. Twenty-three percent reported that more than half of their projects include AV systems.

The Internet of Things is an oft-cited but rarely defined term that holds significant promise for technology professionals including ICT pros. A few years ago IBM defined IoT as “the concept of connecting any device, so long as it has an on/off switch, to the Internet and to other connected devices.” Fair enough. The promise of IoT is that connecting all these devices to the Internet and to one another requires, and will continue to require, massive amounts of networking infrastructure including physical layer cabling. As such, we asked contractors to select, from among a list we provided, the expression that best describes their view of the Internet of Things. Here are the results. (The total equals 101% due to rounding.)

- It has already provided me with new-business opportunities: 33%

- It has not yet provided new-business opportunities, but I expect it to soon: 28%

- It has not yet provided new-business opportunities, but I expect it to in the mid- to long-term: 16%

- It may or may not provide new-business opportunities: 19%

- It won’t live up to the hype: 5%

Wireless service providers’ fifth generation of wireless service (5G) is another technology set that holds promise for demanding the installation of significant amounts of cabling. Fiber-to-the-antenna architectures will support 5G buildouts. Furthermore, as Corning’s manager of global FTTx marketing, Kara Mullaley, points out, “5G isn’t just for the outdoors. Its impact will be felt indoors as well. 5G will ‘break’ a lot of DAS networks, as the antenna placement will need to be closer than in 3G and 4G deployments. Additionally, legacy copper-based infrastructures won’t be able to keep up with 5G bandwidth. To keep up, smart buildings will undergo their own fiber-in-the-horizontal transformation.”

We asked contractors if service providers’ 5G rollouts will provide business opportunities for them. Here’s how they responded.

- Yes, it will provide opportunities for me to be a contractor/subcontractor to these service providers: 24%

- Yes, it will provide opportunities for me with my enterprise end-user customers whose infrastructure will need to be upgraded to support 5G: 22%

- I hope it will provide opportunities for me, but I’m not certain: 35%

- I doubt it will provide opportunities for me: 19%

Finally, amid numerous questions about prospects for increasing business in the months and years ahead, we also asked contractors to tell us whether or not certain United States foreign-policy actions are affecting their business. Specifically, we asked, “The U.S. is involved in a ‘trade war’ of sorts with China, and has initiated tariffs on other countries as well. Have tariffs materially affected your business?” Forty-four percent told us no, tariffs have not materially affected their business. Another 18% said yes they have, but negligibly, with very little business impact. Twenty-four percent responded yes, tariffs have slightly affected their business. Ten percent answered yes, they have moderately affected their business. And four percent told us tariffs have significantly affected their business.

Consultants weigh in

A total of 143 consultants completed our survey. As mentioned earlier, we posed very similar questions to consultants to those we posed to contractors. Here’s a summary and some detail of what we learned from consultants.

For consultants, business in 2019 is comparable to how it is for contractors. Sixty percent tell us business is up by as much as 20%; for 28%, revenues are up 1 to 5%, and for 32%, revenues are up 6 to 20%. Another 12% tell us their 2019 revenues are 21 to 50% higher than their year-ago revenues.

Similar to the number reported from contractors, 10% of consultants tell us business is down 1 to 5% this year compared to last, and another 7% say business has fallen off between 6 and 20%.

The talent crunch is affecting consultants similarly to the extent to which it’s affecting contractors. Forty-two percent of consultants said they haven’t needed to hire any technically qualified employees within the past year. But among those who have had to do so, 42% say they have had some difficulty with such hiring, while 12% say they have encountered significant difficulty hiring technically qualified workers.

Concerning cabling for PoE and remote-powering applications, only 4% of consultants reported that none of their projects involve cabling for these applications. For 11% of consultants, all projects include PoE/remote-power cabling. And for an additional 27%, between 51 and 99% of their projects include the installation of cabling that will support remote-power applications.

AV systems also are a regular course of business for the consultants participating in our survey. While 16% said that none of their projects over the past two years have included the specification, design, or installation of AV systems, for 27%, more than half of their projects in that timeframe included AV.

We also posed to consultants the question about their experience with, and anticipation of, business opportunities stemming from IoT. Here’s how they responded.

- It has already provided me with new-business opportunities: 39%

- It has not yet provided new-business opportunities, but I expect it to soon: 18%

- It has not yet provided new-business opportunities, but I expect it to in the mid- to long-term: 19%

- It may or may not provide new-business opportunities: 20%

It won’t live up to the hype: 4%

- And on the topic of 5G, consultants tell us the following.

- It will provide opportunities for me to be a contractor/subcontractor to service providers: 8%

- It will provide opportunities for me with my enterprise end-user customers whose infrastructure will need to be upgraded to support 5G: 25%

- I hope it will provide opportunities for me, but I’m not certain: 48%

- I doubt it will provide opportunities for me: 19%

Tariffs have impacted business for a minority of consultants. Fifty-two percent tell us that tariffs have not materially affected their business at all, and 16% say tariffs’ effects have been negligible. Eighteen percent report a slight material effect on their business from tariffs, and 9% say they’ve made a moderate impact. Six percent of consultants say tariffs have significantly impacted their business.

End-user deployment trends

In the survey we posed to end-user organizations, we attempted to gain their perspectives on, and capture their experiences with, the technologies and applications about which we also sought information from contractors and consultants. Following is a summary of some of the data points we gathered from end users.

Fewer than one in three end-user organizations—28%—have a wired connection to every user workstation in their network. On the other end of the spectrum, 8% of user organizations told us that fewer than one-in-four of their user workstations are equipped with a wired connection.

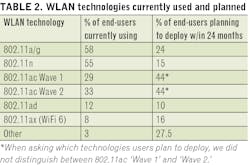

Wireless LAN technologies based on the Institute of Electrical and Electronics Engineers (IEEE) 802.11 specifications are widespread in end-user facilities. Nearly two-thirds of our survey respondents (64%) let us know they plan to deploy new wireless access points within the next 24 months. Those users planning such deployments also let us know which technologies they plan to deploy.As the table on page 8 shows, the deeply embedded 802.11a/g and 802.11n technologies are not as firmly entrenched in end-users’ future plans. More than half of our survey respondents report they have 802.11a/g and/or 802.11n equipment in their networks, but only 24% and 15% plan to deploy 802.11a/g and 802.11n during their next wireless LAN installations, respectively.

WiFi 6, known in some spheres as 802.11ax, currently exists in 8% of user networks, and 16% of user organizations plan to deploy WiFi 6 within the next two years.

In addition to the numbers in the table, 28% of end-user organizations that told us they plan to deploy new wireless LAN technology within two years indicated they are unsure of the specific technology type they will deploy.

Cable matters too, of course. Even if it is installed only to serve as backhaul to a wireless access point, cable is still being pulled and terminated in user organizations everywhere. Eighty-eight percent of our survey respondents had new cabling connections installed in their networks within the past year. As for which types of cable were installed, here’s what they told us: Category 5e: 21%; Category 6: 60%; Category 6A: 49%; OM3: 7%; OM4: 15%; OS1 singlemode: 17%; OS2 singlemode: 20%.

As stated earlier, we asked contractors and consultants about their experience, optimism, or pessimism about the forthcoming 5G generating business for them. With our end-user organizations, we asked, “Do you anticipate that when bring-your-own-device (BYOD) users in your building(s) have 5G-capable devices, you will need a more-robust wireless infrastructure to support their needs?” Forty-two percent answered no, they do not anticipate any such upgrades to be necessary. Thirty-one percent said yes, they will need to upgrade their wireless networks to support 5G BYOD. And 27% told us they will need to upgrade both wireless equipment and cabling in order to accommodate 5G BYOD users in their facilities.

The vendor perspective

Nearly 100 of our survey respondents identified themselves as being employed by either manufacturers or distributors of communications-systems products and systems. We structured their survey to obtain information and opinions on some topics we also asked other professionals.

For example, vendors weighed in on 5G. We asked them to choose which statement best represents their belief about the impact that 5G’s rollout will have on their business prospects. Here’s how they answered. (Total exceeds 100% due to rounding.)

- It will help my business with service providers and enterprise end users: 57%

- It will help my business with service providers only: 11%

- It will help my business with enterprise end users only: 11%

- It will not help my business with either service providers or enterprise end users: 22%

On the topic of tariffs, we asked vendors not only if they are being affected, but also if so, what they are doing as a result. Thirty-seven percent say no, they have not incurred tariffs. Forty-three percent have incurred tariffs and have passed the additional costs along to their customers. And 20% have incurred tariffs and have absorbed them rather than passing costs along to customers.

Modular plug terminated link

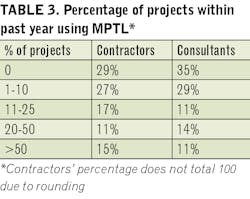

The modular plug terminated link (MPTL) is a construction in which the work-area end of a horizontal cable is terminated to a plug. The MPTL plugs directly into the network device, such as a wireless access point or camera. In many cases, the MPTL also delivers power to the device via PoE. The TIA-568.2-D Balanced Twisted-Pair Telecommunications Cabling and Components Standard, published in 2018, recognizes MPTL.Our survey gave us an opportunity to measure the use of MPTL, and we included questions about this connection type to the contractors, consultants, and end-users we surveyed. The nearby table details what contractors and consultants told us about their use of MPTL over the past year. A significant majority (71% of contractors and 65% of consultants) installed and/or specified MPTL within that time.

From end-user organizations that have installed new cabling links within the past year, we sought to learn not only if they used MPTL but also if they are familiar with it. They told us the following. (Total exceeds 100% due to rounding.)

- I implemented MPTL for all new connections within the past year: 15%

- I implemented MPTL for some new connections within the past year: 24%

- I did not implement MPTL although I am familiar with it: 42%

- I did not implement MPTL and I am not familiar with it: 20%

As the ICT industry arrives at 2020, a vortex of technical, cultural, legislative, and policy issues combine to shape what will come in the next decade. We hope this snapshot from your industry peers is insightful to you.

Patrick McLaughlin is our chief editor.