By Matt Vincent

Global copper pricing is ever an up-and-down proposition, though some see increased stability for ’07.

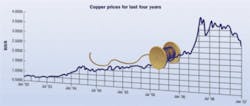

In the first week of January, amid rising global inventories, the London Metal Exchange (LME; www.lme.co.uk) reported that copper prices had dropped to a nine-month low, falling roughly 30% to less than $6,000 per metric ton, down from a record high of $8,800 per ton reached in May 2006. Concurrent January price quotes issued by the New York Commodities Exchange (Comex) saw commodity futures for high-grade copper hovering near $2.35, down from a peak of more than $4 since last May.

Most industry observers have attributed this “softening” in the copper market to two major factors: a sharp decrease in Chinese imports, and the yearlong (some might say Hindenburg-esque) bust of the U.S. residential construction market, which in itself instigated a slump in demand for copper tubing used for plumbing.

The combination of factors has contributed to a surplus in global copper reserves, while recent labor resolutions at mining operations, such as Chile’s state-owned Codelco (the world’s largest copper producer, where workers’ unions finally settled upon terms of compensation) have also served to assuage the market.

Less volatility ahead?

As a result, “the likelihood of a price spike happening now [in Q1 of 2007] is really sort of next to zero,” estimates Jon Barnes, principal consultant at the UK-based CRU Group’s (www.crugroup.com) copper fabrication practice. “The threat of problems with possible strikes in Chile seems to have abated; I don’t think there’s anyone who thinks that’s going to happen now; it’s steadily become less and less of an issue in the marketplace. Without that potential disruption, I think there’s every chance that, through next year, copper prices will continue to trend lower and, hopefully, less volatile.”

Barnes’ forecast is exactly what manufacturers and distributors of data communications cabling want to hear. Less volatility and flux in the copper market is what’s optimally desired. As Todd Harpel, director of marketing for cable manufacturer Berk-Tek, a Nexans company (www.berktek.com), points out, “The data cable business is different from the energy cable business, who actually can price their product according to the copper market on a daily-and in some cases, even hourly-basis. The data cable business looks much more at the trend over a period of two to three months before they make any changes in pricing structure.”

Taking a longer view in analyzing the fluctuating market, a representative at another manufacturer of copper data cabling (who commented for this article but wished to remain anonymous) notes that the rise in the price of copper over roughly the past three years from about 90 cents to last May’s $4 apex in essence represents a real increase in price of about 350%. The representative further suggests that as the price of the metal rose, there was a “kind of a speculator’s premium built in” that served to somewhat inflate pricing; an effect which, since the heights of mid-2006, has “kind of gone away.”

“There were a lot of hedge funds and other types of investment people that were playing the commodities, which had been shooting up so much; they wanted to get on the bandwagon,” contends the representative. Subsequently, as the price of copper reached its (latest) plateau during the period between May and July of last year, the representative suggests that “a lot of the speculators got out of the market. They don’t like markets that aren’t moving as much, because they can’t make as much money if there aren’t those extremes where they can buy and sell a whole bunch of transactions in the space of a few weeks.”

The burden of expectations

So, how will the softened copper market of early 2007 affect manufacturers’ and distributors’ pricing strategies for the year ahead? Does the question assume too much, i.e., that the market will necessarily even stay soft? Is this a risky proposition, given the market’s recent history?

Michael Dumas, vice president of Comm/Data for communications distributor Graybar (www.graybar.com), maintains that the market data his company received coming into 2007 predicted that the market would stabilize and trade within a reasonable range. “I would think that [the market] would stay reasonably stable, but there’s certainly no guarantee,” he says. “Merger and acquisition activities, like Freeport McMoRan’s bid for Phelps Dodge, could create additional volatility or supply and demand issues. The volatility is what hurts, not necessarily where the market is.”

Berk-Tek’s Harpel adds, “From our perspective, keep in mind when you start talking about copper going as high as $4, we’ve already had customers who are saying, ‘well, now it’s come down to below $3, when are you going to lower your price?’ Well, it was a $1.75 a year ago [in December 2005], so it’s still significantly higher than it was this time last year.”

Says Dumas, “You find some distributors being more aggressive than others with their pricing practices; however, distribution’s acquisition costs have not declined, so pricing discipline is critical to maintain reasonable margins. As the market softens, or softens further, it might create expectations that prices may come down. If copper pricing continues to drop, expectations will likely gain momentum.”

While noting that his company passed along some of its cost increases for raw materials in the form of price increases to the market in the May and June 2006 time frame, Harpel observes that “as the price of copper has kind of settled out, we’ve seen that pricing has stabilized amongst all the cable manufacturers, but that the copper market has not jumped more than, I would say, 15 cents in either direction in any one month.” As such, Harpel concludes that his company is “relatively confident that as we close 2006, the pricing structure that we have in place today is right for where the raw material costs are.”

Nonetheless, the previously cited representative from a cable supplier points out that cable manufacturers and distributors who purchased when the copper market was at its height may require several months to “flush through” the higher cost materials and/or end products before their pricing will be able to reflect the lower costs of the softened market.

“Then I think you’ll see some price decreases,” says the representative, depending upon when a given manufacturer or a distributor “feels that their costs are really lower.”

Further, should the soft market be prolonged, the representative notes that for contracts including an escalation/de-escalation clause, manufacturers and distributors will “certainly have to honor it, and certainly their customers will probably come to them and say, ‘hey, you’ve had several price increases when copper was going up, now I want to see a price decrease or two when copper is going down.’ And they’re going to have to pick a number and do the arithmetic and do that.”

Graybar’s Dumas agrees. “Ultimately, distribution doesn’t control raw materials pricing, so as the market becomes volatile and/or changes, we have to change along with it,” he says, adding that “overall, I think we’d probably all prefer that raw material costs stay stable.”

China concerns

As with many aspects of the global economy these days, particularly manufacturing, the 900-pound gorilla can be summed up in one word: China. Recent analysis from Salon.com states that in the first 11 months of 2006, China imported 35.5% less copper than in 2005. CRU Group’s Barnes concurs, that “what we’ve really seen through this year is this big reduction in Chinese refined copper imports.”

Barnes explains, “It’s not a simple picture. I don’t think anyone really understands it entirely. If you look at the Chinese economy, it’s growing just as fast this year as it was last year, and will probably grow just as fast next year as this year. So, why have we seen this discontinuity in Chinese refined copper demand?”

The first reason for the reduction in imports, says Barnes, is that China produced about 15% more refined copper in 2006 than in the previous year. Another reason is that the Chinese government is known to have amassed a strategic reserve of copper over the past several years. According to Barnes, while “nobody really knows how much copper they’ve got, it’s been clear this year that they’ve been running down these domestic stocks by selling copper to local consumers,” further reducing the country’s need to import copper from abroad.

Also, says Barnes, the Chinese have recently been importing more scrap copper as a cheaper alternative to refined. “Over the September to November [2006] period, they’re probably running to 20 to 30% higher than the levels were at this time a year ago,” he reckons. “You could see that as a leading indicator of China returning to the market to buy refined copper. It’s not clear, but I see it as a potentially bullish factor for the copper market and copper pricing.”

Barnes concludes, “Fundamentally, what I think we’ve seen this year in China is a short-term discontinuity. China will be back next year. You just know it’s going to be the case, because while the Chinese economy continues to grow, it’s going to need more and more copper. We think China’s copper demand is going to recover in 2007 and probably grow by about 7%.”

Forever up and down

On January 10, as this article was being completed, Bloomberg News (www.bloomberg.com) reported that copper prices in New York had leapt the most in two months on concerns that output at Chile’s Codelco mine might be disrupted by a rockslide feared to be imminent at the company’s largest mine at Chuquicamata.

On that news, the wire service reported that Comex copper futures for March delivery increased 11.6 cents, or 4.5%, to $2.672 a pound, and that a close at that price would mark the metal’s largest gain since last October. Copper traders on the day were quoted as expecting a closing price somewhere above $2.70.

At the time of the report, the wire service noted that copper had dropped 11% in January after climbing 41% in 2006-the fifth-consecutive annual gain. Not coincidentally, copper prices reached their May 2006 record of $4.04 after strikes and mine accidents at the Codelco mine curbed production.

“The Codelco story could cause some nervousness, but copper needs to put together a string of gains [before buyers] come back in any meaningful way,’’ reported Edward Meir, an analyst at Man Financial Inc. (www.manfutures.com)MATT VINCENT is senior editor for Cabling Installation & Maintenance.