Regardless of the wireless technology employed, fiber will be the supporting infrastructure for 5G networks.

By the L-Com Global Connectivity technical staff

The stringent requirements for 5G heavily rely upon the interconnected backbone in the short term. Intensive 5G fiber-optic backhaul is necessary to seamlessly stream bandwidth-intensive applications such as 4K video. For a while it seemed this technology was in the future, but with the most recent World Radiocommunication Conference (WRC) already allocating some of the millimeter-wave spectrum to 5G and major U.S. telecommunications companies such as Verizon and AT&T already announcing plans to launch 5G service by late 2018, it seems gigabit high speeds, and low-latency cellular capabilities are fast approaching. This invariably requires the use of fiber optics to minimize the time-to-market of massive small cell deployments—a major milestone for the roadmap to 5G. The benefits of low cost and reliability combined with major advancements toward 40-Gbit/sec and 100-Gbit/sec speeds have made fiber optics a default option for many leading mobileoperators.

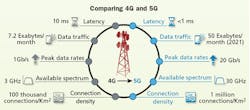

5G connectivity is defined by the characteristics latency, data traffic, peak data rate, available spectrum, and connection density. Original image credit: Qorvo

5G at a glance

The ubiquitous 4G cellular technology is poised to be replaced by 5G. However, the lofty goals for the level of connectivity required in 5G networks has been subject to much criticism. However, these requirements were generated in order to support the nearly exponential increase in connected devices in the coming decades. The current prediction, according to Statista, is 75.4 billion connected devices by 2025. This number includes both Internet of Things (IoT) devices and mobile phones where short-range IoT devices are expected to surpass the number of mobile phones by 2025. In the IoT space, the myriad system requirements have led to a proliferation of standards committees and hardware designs backed by a variety of protocols. So it follows that there are often somewhat disjointed technologies with compatibility issues in the IoT realm. Systems such as Zigbee, Z-wave, and Bluetooth are really meant for short- to medium-range static applications with nominal throughputs (< 1 Mbit/sec).

Cellular technologies, however, are a different beast altogether. Not only must a handheld device stay connected while mobile, but in order to be considered 5G-compatible, it also must be able to stream what is essentially 4K video seamlessly regardless of the traffic density hitting the base station. Furthermore, 5G technologies, from the chipsets to the user equipment (UE) to the cell towers must be compatible across all the radio access networks (RAN) that 5G will have to use. This led to a few major global organizations dedicated to the standardization of 5G, that often have a history of releasing previous generations of wireless standards (i.e. 3GPP, GSMA, ITU).

Several hardware methodologies have been developed to help achieve 5G. One is massive MIMO—massive multiple-input/multiple-output—or outfitting a base station with hundreds of antennas to reach 5G-rate spectra efficiencies and data rates in sub-6-GHz mobile applications. To date, there are a handful of successful massive MIMO trials with spectral efficiencies on the order of 140 bits/sec/Hz. This technology, however, is not yetcommercialized.

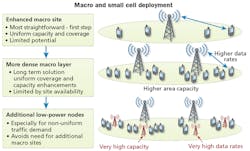

The 5G timeline includes the installation of additional macro cell sites and small cell sites, both requiring significant fiber backhaul. Image credit: Chronos

Another methodology is using the millimeter-wave spectrum with dense networks of microcells in urban areas as the high available bandwidth can easily allow for wireless links with gigabit speeds. The downside is this is mainly for static line-of-sight (LoS) user equipment, as the high-frequency signals easily create multipath components when running into obstacles. Lower-frequency signals have the ability to diffract around objects where higher-frequency signals would scatter, allowing for a higher likelihood of an LoS wirelesslink.

The 4G-LTE-to-5G roadmap

Early in 2018, AT&T claimed they would have 5G available by the last quarter of the year, and Verizon was soon to follow. In reality, 2018 “5G” is more likely an advanced 4G LTE and a 5G precursor. Fixed wireless access services are already being launched and traffic offload to the unlicensed spectra are already being implemented to support high traffic andthroughputs.

Moreover, the current infrastructure is being modified to support LTE-Advanced (LTE-A). Small cell installations are well underway with 13,000 already deployed for Verizon’s 5G infrastructure. This densification will continue along with the implementation of peripheral technologies (e.g. 2G, 3G, AirGig, WiGig, 10G-PON) to support seamless 5G gigabit speeds even at times of high trafficdemand.

A view of the deep fiber deployment that may be necessary to support 5G. Original image credit: Deloitte

Macro cell backhaul

According to the CTIA, more than 3.7 trillion megabytes of mobile data were consumed in 2016 in the United States alone; that’s 35 times the volume of traffic in 2010. While legacy 2G and 3G networks leverage time division multiplexing (TDM) circuits with copper-based interconnect, more modern 4G networks require that the backhaul (and fronthaul) of mobile data rely on packet-based transport over fiber. Traditional mobile backhaul—or the transportation of mobile data from the baseband unit (BBU) of a macro cell site to the mobile switching telephone offices—has used 1-Gbit/sec macro backhaul links. Yet this is evolving with 4G LTE-A supporting downlink rates at 3 Gbits/sec and uplink at 1.5 Gbits/sec with features such as enhanced inter-cell interference coordination and coordinated multipoint. This requires the use of upgraded fiber-optic links to support these higherthroughputs.

Mobile fronthaul is a newer mobile architecture in which the data at the macro cell site is transported from remote radio heads and sent to a centralized BBU. Fiber optics also are currently mandated for mobile fronthaul in order to support the high-capacity Common Public Radio Interface (CPRI) or Open Base Station Architecture Initiative (OBSAI) protocols with rates that go as high as 10 Gbits/sec. Naturally, fiber and more legacy copper-based technologies will continue to support backhaul and fronthaul for MBB along with a number of other technologies, namely smallcells.

Enhanced 3G and 4G-LTE macro sites are being deployed in increasing density in order to keep up with traffic loads in urban areas. Where macro sites cannot be deployed closer to users, additional low-power nodes, or small cells are installed in a multi-layered heterogeneous network topology. Also known as microcells, picocells, and femtocells, these small cells can either use the already-congested cellular spectrum or the more-available millimeter wave spectrum. Backhaul in this heterogeneous dense network connects both the small cell and macro cell sites to the core network and this can be done over-the-air, with copper-based interconnect, orfiber.

Small cell backhaul

According to a survey conducted by the Telecommunications Industry Association (TIA), 5G operators consider fiber important for 5G backhaul, with 83 percent of respondents saying fiber is “very important.” This likely is due to the fact that initial small cell deployments often use the millimeter wave spectrum and will likely rely heavily upon a high-speed wireline for backhaul. As discussed earlier, the wide available bandwidths and high throughputs that come with the millimeter waves have the downside of high atmospheric attenuation, ease of signal scattering, and successful uplink/downlinks only in LoSscenarios.

This significantly narrows down the available options of millimeter wave network topologies, particularly over distances beyond tens of meters. However, this can be seen as a win-win for landline carriers and telecommunications companies as the costly last mile fiber-to-the-home is replaced with more agile fixed wireless access solutions while the 5G traffic offload for small cell networks will rely upon deep fiber installations to carry signals kilometers away. This way, small cell deployments can be in locations that are hard to reach by dedicated fiber or other copper wired alternatives, while fiber can run distances that small cell signals are not able toreach.

While wireless links may not be a viable option, Gigabit Passive Optical Network (GPON) deployments are currently being deployed to support 5G speeds over long distances. In late 2017, AT&T completed 10-gigabit-capable symmetric passive optical network (XGS-PON) trials in order to merge all services onto a single network, including the 5G wireless infrastructure. Verizon is adopting Next Generation PONs (NG-PON)—a gigabit-capable PON with more wavelength added to the fiber installation—for last milerouting.

The ultimate goal is to provide a software defined network (SDN) infrastructure to support bandwidth-heavy applications such as virtual reality, augmented reality, and artificial intelligence in order to more readily manage consumer and business broadband network access. This layer of abstraction for the virtualized network functions eliminates the need to physically allocate hardware to vendors or consumers depending on data demand/usage.

The significant trend toward the urbanization of human populations leads to much more densified networks in metropolitan regions, and underserved rural regions. Source: European Space Agency

Rural backhaul

A Deloitte analysis has estimated that the U.S. required between $130 billion and $150 billion over the next 5 to 7 years to adequately support broadband competition, rural coverage and wireless densification. According to Deloitte, nearly $35-40 billion of that should be dedicated to deployments in rural areas. With that being said, the numbers have not been very promising. More than a decade after the first fiber-to-the-home installations, 61 percent of the rural population have access to 25-Mbit/sec broadband, paying a hefty premium at 3 times the cost to suburbancustomers.

Just like their urban and suburban counterparts, rural geographies likely will have to implement a number of different technologies to access mobile broadband including millimeter wave transmission, satellite backhaul, and fiber installations. AT&T, for instance, has already deployed Project AirGig trials in order to deliver broadband wireless internet to “urban, rural and underserved parts of the world” using antennas attached to existing powerlines.

According to AT&T, AirGig will be capable of delivering multigigabit internet on a license-free spectrum to keep up with the anticipated speeds of 5G networks. The IEEE 802.22 standard, also known as “WiFar,” leverages the unused sub-1-GHz television white space to offer link distances of up to 20 km with rates as high as 30 Mbits/sec—still not even close to the 20-Gbit/sec peak data rates for 5G. On the satellite front, geostationary high throughput satellite technology leveraging the Ka-band and, implementing frequency reuse schemes, is allowing for data rates approaching 100 Mbits/sec globally. Furthermore, low- and medium-earth orbiting constellations with 1000-plus projected satellites are emerging that will provide “internet to thepoles.”

While fiber runs are costly as routing optical cabling through the ground requires the unearthing and installation of cabling as well as its respective maintenance, it may still be necessary in the short-term to provide a more immediate solution for broadband mobile and internet. Indiana Fiber Network, for instance, has already invested $20 million in fiber network for urban and rural geographies. Most of the previously described technologies are still in their infancy compared to the technology readiness level offiber.

There is no one-size-fits-all solution for 5G backhaul and that would be antithetical to the trend toward “network slicing.” While millimeter wave backhaul will be critical in both dense urban environments and even potentially in rural environments with AirGig, it is evident that fiber plays a vital role in supporting the ever-increasing data demand for both the short-term and long-term. Microwave, millimeter wave, Ethernet, and fiber will likely dominate 5G precursors such as LTE-A and ultimately 5G backhaul installations.u

This article was authored collectively by the technical staff at L-Com Global Connectivity.