FTTP/FTTH: Has promise become reality?

The momentum is quietly building for fiber-to-the-premises/fiber-to-the-home (FFTP/FTTH) in the United States. Industry analysts contacted by CI&M insist that FTTP and FTTH represent a sharply growing market for the next several years.

Still, the United States remains behind many other parts of the world when it comes to FTTP/FTTH. But analysts say this will change-slowly but almost assuredly-as the larger regional Bell operating companies (RBOCs) BellSouth Corp. (Atlanta, GA; www.bellsouth.com), SBC Communications Inc. (San Antonio, TX; www.sbc.com) and Verizon Communications (Irving, TX; www.22verizon.com) push for the delivery of these networks.

"We are seeing it evolve," says Barry Kantner, vice president of World Wide Packets (Veradale, WA; www.wwp.com). "We are seeing the abilities to have one single access point, and to have much less operational expenses."

One reason for the presumed growth is that the Federal Communications Commission (FCC; www.fcc.gov) ruled in October 2004 that new fiber access and IP networks would not be subject to so-called "sharing" rules. Many RBOC executives had said that these rules were preventing them from making large commitments to new network developments.

Following the FCC statement, BellSouth announced that it would increase by 40% in 2005 the number of homes it annually equips with an advanced fiber platform. SBC likewise announced it would accelerate its Project Lightspeed by two to three years-spending roughly $6 billion to bring fiber to or close to 18,000,000 homes.

Verizon, meanwhile, announced the locations of many of the projected optical-fiber deployments for its FTTP services. It also announced it would hire 3,000 to 5,000 new employees for these projects.

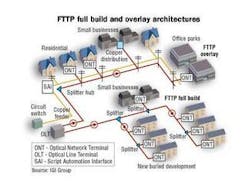

FTTP and FTTH are often referred to as FTTX. The "X" refers to the installation of optical fiber to both commercial buildings and residences. Fiber can deliver Voice over Internet Protocol (VoIP), Internet access, business data services such as transparent LAN, video services such as video conferencing, and emerging services such as security, online gaming and distance learning.

Singlemode optical fiber is the fiber of choice for FTTP/FTTH with most RBOCs. Singlemode fiber is commonly used with laser sources for high speed, long-distance links, and is ideal for building-to-building or campus wiring.

"It is high bandwidth," says Paul Polishuk, president of IGI Consulting (Brighton MA; www.igigroup.com). "At one time, people thought this would be tough to handle in the field, but the pre-connectorized cable seems to have solved the problem."

But if there is optimism about fiber deployment for FTTP/FTTH, it's guarded optimism for an industry that is still making its way out of a lagging economy.

"Definitely, the impact will be positive on singlemode fiber deployment, but it's difficult to quantify how great that impact will be," says Hui Pan, chief economist for IGI.

Contractor, subcontractor opportunities

Consultants who follow the FTTP/FTTH markets believe installation opportunities in the US have the potential to be lucrative for cabling contractors and for the subcontractors who work with them. Polishuk says contractors should strive now to make alliances with equipment manufacturers to get the work. "That would be the way to get in," he says.

"It will be big business for the contractors," Polishuk continues. "The big guys will subcontract to other people, too. They will need lots of people in the field doing the installation work, so the little guys will team up with the big guys."

But if optical-fiber deployment for FTTH/FTTP does increase, it will be a change from today's environment. FTTH/FTTP penetration in the US remains small. Only 10 states in the US have FTTH. "It's room for growth," admits Sharon Eisner Gillett, associate for the Communications Futures Program, MIT (Cambridge, MA; www.mit.edu).

Gillett says prospects for FTTH growth remains the strongest in municipalities that have electric utilities. She also says that despite the FCC's promises, the incentives here, compared to other parts of the world, are lagging. In the United States, the government is now eliminating some of the access targets for broadband deployment, which means the only major policy incentive offered to broadband deployers is unbundling.

This is a more passive stance than Asian governments are taking. In the US, the government eliminates the barriers to broadband, but allows the market to take care of itself. RBOCs and carriers alike are competing in the US marketplace, and the strongest will win. As a result, Verizon, BellSouth and SBC are under tremendous pressure from cable operators to compete for the last mile and provide access to homes.

"We are optimistic that, fundamentally, the RBOCs are getting ready to deploy fiber directly to the home or to the node or neighborhood," says Pan.

But costs remain an inhibitor in the US. It requires a larger amount of investment to bring fiber to the home, curb or neighborhood. And while the financial balance of carriers is improving, analysts say they still have to be cautious in terms of deployment. Carriers are are selectively rolling out the service, but analysts believe this deployment cycle will pick up speed when equipment manufacturers can lower the unit costs, and when carriers deploy more and larger orders are placed. "They are going hell bent for election," says Clif Holliday, president of B&C Consultant Services (Colleyville, TX; www.ieee.org).

Verizon has completed its first commercial deployment of its FTTP system in Keller, TX. Holliday notes that the system will deliver broadband fiber to every residence and business in the city. The installation was completed in the summer of 2004, with commercial service now available to every location in the city.

The system will provide voice services and high speed Internet access. This year, Verizon plans to offer video services. In the next three years, 80% of the customers will have super high-speed DSL access. The Keller project cost $15,000,000; or, with 14,000 households in the city, about $1,071 per home.

"They have put fiber in every place, and they are making their FTTP available to everybody there," says Holliday.

The RBOCs will eventually get to the smaller cities and towns, Holliday says. But for now, the carriers will be picking their markets. "Obviously, they are not going to go to the tiny, rural places first," says Holliday. "They are going to where they think they can sell it first."

Asian market differences

By comparison, Pan says FTTX continues to grow at a more rapid rate in many Asian countries. Indeed, fiber-to-the-apartment continues to be the norm in many of these countries. Broadband is prevalent in Asia; Both South Korea and China are delving into FTTP, and are expected to be very big markets in years to come. South Korea is ahead of the United States when it comes to FTTX deployment. Seventy percent of all South Korean households now subscribe to broadband.

China is also a developing market, and has five-year plans and macro deployment strategies for service providers to reach. In the FTTH market, there are several trial networks, including Netcom and Telecom, and the Great Wall Broadband Network.

When it comes to FTTP, Japan is the leading country with more than on million users. "The fiber-to-the-home market is beginning to take off in Japan, and is very promising in China and South Korea," says Pan.

BRIAN MILLIGAN is senior editor for Cabling Installation & Maintenance