The important role cabling plays within the network is finally being recognized by network managers, who are now viewing high-performance cabling as a good investment for the building infrastructure.

These are the conclusions of a survey conducted by Systimax Solutions (www.systimax.com), which has been compiled in a report, Meeting the Network Connectivity Challenge.

“Managers are recognizing the network cabling infrastructure as being important and a good investment,” says Mike Barnick, senior manager, solutions marketing, Systimax Solutions. “Their responses show they are moving from Category 5e to 6 and 6a, and talking about Gig and 10-Gbit networks. When the standard becomes ratified, we will see mass acceptance toward these higher speeds in the cabling infrastructure.”

Barnick says this year’s survey represents a cross-section of network managers that include retail, government, financial and other industries. Fifty-four percent of respondents said they were responsible for data centers.

The global research study was conducted among 2,165 information technology (IT) professionals. The report includes responses representing 48 countries, and Systimax argues that its new report shows the important role of connectivity within the network. Systimax conducted a similar survey in 2002.

Seventy-two percent of respondents said they would select Category 6 or 10-Gbits/sec Augmented Category 6 UTP copper cabling for a new installation. More than half (56%) of the respondents would install Category 6 cabling, while 16% would opt for Augmented Category 6 cabling.

Systimax argues that the results indicate a likely rapid shift toward Augmented Category 6 cabling, despite the fact that development of standards have only recently commenced and market awareness of Category 6a remains fairly low.

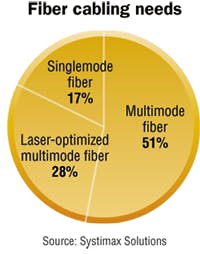

To meet fiber cabling needs, 51% of the respondents to a Systimax survey said they would choose multimode fiber, and a further 28% would choose optimized multimode fiber (OM3). Use of OM3 fiber was far higher than average among companies that specified Augmented Category 6 cabling (51% vs. 28%), showing that managers selecting advanced copper solutions also choose better fiber technology.

“The Category 6a (Augmented Category 6) standard will be a complete and ratified standard in 2006, but now, the cabling requirements are being firmed up and stabilized, and multiple vendors are referencing it and introducing solutions,” says Barnick.

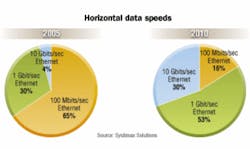

Within five years, most respondents expect to be running primarily 1-Gbit/sec (53%) or 10-Gbits/sec (30%) over their horizontal cabling.

Thirty percent of the respondents say they expect to implement 10-Gig-over-UTP during the next two years in their data center. Barnick says these results indicate a new awareness and appreciation that data-center managers have for 10-Gig-over-UTP. He says this is a significant finding, given that it will probably be another year before the standard is completed.

“The point is that they have an understanding of what Category 5e is about, as well as 6 and 6a. And from the data-center standpoint, that is the prime area that you see Category 6a implemented and where you will see the bandwidth need to be the greatest,” says Barnick.

Systimax also believes the survey results confirm industry perceptions that Category 5e is fast approaching obsolescence, with only 17% of respondents selecting this option.

The survey reveals that where fiber cabling is required, 51% of the respondents would choose multimode fiber and a further 28% would install laser-optimized multimode fiber (OM3). Barnick argues that this acceptance of OM3 fiber shows a rapid advance over the responses from the 2002 survey, where only 4% of respondents were using the new fiber technology.

Barnick says this reveals that while data-center managers are still relying on legacy multimode systems, there will be a migration to OM3 as they gain more knowledge about its higher bandwidth potential. “Multimode and laser-optimized multimode fiber cabling are a great alternative to singlemode cabling,” says Barnick. “It [multimode] is less expensive.”

He also believes that “OM3 will become more deployed into networks. There will be an up-tick in the purchase of laser-optimized multimode as IT managers realize the bandwidth value and its cost effectiveness.”

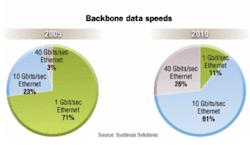

In five years, 61% of the Systimax survey respondents expect to be running 10-Gbits/sec and 26% plan 40-Gbits/sec in their backbones.

Within five years, most respondents said they expect to be running primarily 1-Gbit/sec (53%) or 10-Gbits/sec (30%) over their horizontal cabling. In five years, 61% expect to be running 10-Gbits/sec and 26% 40-Gbits/sec in their backbones. Barnick says this shows a continued increase in data rates from the 2002 survey, and is an indication of why high-performance cabling is being deployed to protect against obsolescence.

When asked to select the single most important factor in making their cabling investment decision, 30% of the respondents cited the solution’s technical performance. Total life cycle cost was rated second (15%), and quality of product was rated third (14%). A total solution offering and initial cost were rated fourth (13%) and fifth (11%) respectively.

Barnick says respondents who consider total life cycle cost as their priority are more likely to choose higher-performance cabling solutions, which indicates a better understanding of cabling solutions as a long-term investment. Respondents who would choose lower performance cabling rate initial cost as the most important factor far more often than those who choose Category 6 and Category 6a cabling.

When asked about the importance of effective cable and patch cord management within the rack and cabinet, 87% of respondents rated this as very high or high. Barnick says the response highlights the need for adequate space and management provisioning in cabinets and racks.

If only they knew

Forty-nine percent of the respondents have not yet considered intelligent patching to help manage their infrastructure. But 19% now use intelligent patching in either part or all of their network, and a further 26% plan to use it in new installations. Barnick says this signals a move towards faster adoption of intelligent infrastructure management.

Still, 36% of respondents rated their knowledge and understanding of intelligent patching as low, or said they had no knowledge of it at all. Barnick says this indicates that increased awareness of the benefits of intelligent infrastructure management will likely further accelerate the technology’s adoption.

“There is a value in intelligent patching,” says Barnick. “If they knew more about it, it would be more acceptable to them.”

Rounding out the survey, respondents were asked to comment on the benefits of integrating communications for IT and building automation systems. When asked to compare the current situation to three years ago, 61% of respondents felt that there has been an increase in the inclusion of low-voltage building systems on the network infrastructure, and more than half (59%) are considering this type of integrated network infrastructure.

An article in our May issue about cable trays incorrectly reported that Gulf Coast Systems’ J-Tray System includes a flexible center post that lets it be supported from a ceiling or wall. In fact, the center post, or Universal Fastening Aperture, is not flexible. The top of the aperture can be attached to a threaded rod, which lets it be attached to a ceiling. Editors