Cabling market's growth path could be a rocky road

From the December, 2013 Issue of Cabling Installation & Maintenance Magazine

While analysts generally agree the drivers of network infrastructure deployment will tick up in the years ahead, the dynamics within layer one merit close watching.

by Patrick McLaughlin

Analysis and market-research figures focused in and around the structured cabling industry indicate that in the several years ahead, the global market is poised to grow rather than stagnate or decline. That growth is likely to occur at a modest pace, according to predictions, and multiple influences will affect how and where that growth will take place.

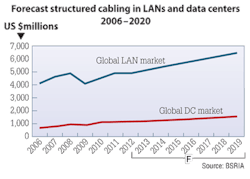

In September, market-intelligence organization BSRIA (www.bsria.co.uk) produced a study on the outlook for the global structured cabling market to the year 2020. The study also includes data on the structured cabling products sold globally by region through 2012. As for projections, BSRIA concludes that by 2020 the total market will exceed $8 billion. It totaled $6 billion in 2012 and will chart a course of 4-percent annual growth through 2020 when it reaches $8.3 billion, BSRIA says.

It commented, "Structured cabling in data centers continues to move toward the use of fiber. The number of smaller data centers that mainly use copper will decline as the penetration of cloud services increases and outsources become more prevalent." Concerning corporate LANs, BSRIA added, "The number of outlets per desk and number of workstations will decline, but growth in emerging markets as well as the use of Ethernet networks to connect and even power other devices will have a positive impact on the market."

Among the key findings in BSRIA's study are the following.

- Cabling in data centers accounted for $1.1 billion in 2012 and is expected to grow to $1.6 billion in 2020. The increasing use of smartphones, tablets and laptops, and the need for file sharing, networking and instant access, will massively increase the need for data storage and speed. Business will increasingly shift from buying IT products to purchasing infrastructure-as-a-service (IaaS), and software-as-a-service (SaaS). Both trends will boost the need for storage and increase the demand for data center capacity.

- Significant growth in WiFi traffic is expected. Small cell and carrier WiFi deployments are expected to carry more than 60 percent of mobile data traffic by 2020. Convergence will increase and more structured cabling will be used to wire access points, Internet Protocol (IP) cameras, building management systems, access controls and other applications. Overall cabling in the LAN is expected to grow from $4.9 billion in 2012 to $6.7 billion in 2020.

BSRIA introduced its findings and commented on business conditions in general by stating, "The structured cabling market is facing a turbulent time." Based on information and forecasts produced by other market-research and analyst firms, that statement by BSRIA is apropos. A forecast report from Dell'Oro Group (www.delloro.com) in the summer of 2013 focused on what it called the "enterprise edge" market. "Enterprise edge is the part of the communications market that includes enterprise-class wireless LAN [WLAN] and campus Ethernet switching equipment and related software," the organization explained when projecting that market to exceed $15 billion by 2017. It said that in the years being forecast, WLAN growth will take revenue share from campus switching. "Enterprises are now emphasizing WLAN connectivity as a primary means of connecting workers to the corporation," said vice president of enterprise edge research Chris DePuy. "We foresee relatively steady growth for the overall segment as enterprises expand wireless access and maintain switched access."

A separate indication of the turbulence facing the structured cabling market was expressed in a survey report from Infonetics Research (www.infonetics.com) midway through 2013. When announcing the availability of its Network Equipment Spending and Vendor Leadership: North American Enterprise Survey, directing analyst for enterprise networks and video Matthias Machowinski said it "uncovered a solid outlook for network equipment spending, driven by the ever-growing demands placed on network infrastructure. But not all is well: There is a disconnect between the growth in network usage and enterprise budgets, and cost containment is one of the top priorities over the next year. Vendors who can solve this challenge are best positioned to take share in this $27-billion-a-year market."

One of Infonetics' findings counters the longer-term projection put forth by Dell'Oro. The Infonetics survey data showed that "respondents planned to slightly throttle WLAN expenditures for the year, correspondingly increasing router and switch outlays."

Centers of data

BSRIA's cabling forecast indicates data centers will outpace general LANs in terms of growth, though both will expand through 2020. Some view data centers as an industry in and of themselves, with multiple segments each of which can be assessed and analyzed. Those that address the computing and networking operations that define what a data center does, also can lend insight into what could be driving the growth of cabling deployments in these facilities. And several researchers have done just that.

Dell'Oro recently published the Data Center Disruptors Advanced Research Report, in which it predicts the software defined networking (SDN) market will grow more than sixfold over the next five years. Alan Weckel, vice president at Dell'Oro, noted, "Almost every major Ethernet switch vendor with exposure in the data center is announcing significant new products," in the weeks that followed the report's release date—October 31. "To put perspective on the order of magnitude of the data center equipment market, in 2013 sales will exceed $100 billion, split among servers, storage, Ethernet switches and data center appliances, et cetera. We predict a wide variety of manufacturers will engage in battle for the supremacy of data center spending and control. For Ethernet switching, data center share will become an increasingly important metric for three reasons. Almost all revenue growth in this market over the next five years will come from data center products; vendors will have to fight each other for ever-fewer, though larger, deals; and SDN is changing who owns application and network control points."

In September, Dell'Oro reported on the Layer 2-3 Ethernet switch market for the year's second quarter. At that time Weckel said, "Cloud providers' insatiable demand for network equipment continues to spur almost all the revenue growth in the Ethernet switch market. Cloud providers' demand is offsetting delays in enterprise spending as enterprises push out the migration from 1 Gigabit Ethernet to 10 Gigabit Ethernet. Yet as the cloud market matures, we believe growth in the data center could likely stall in 2014, and remain on hold until 2015 when enterprises begin en-masse migration to 10 Gigabit Ethernet. We see many enterprises remaining comfortable with 1 Gigabit Ethernet as most server platforms lack low-price 10-GbE connections, which are enabled by LAN-on-motherboard."

In that report, Dell'Oro also noted that 10 vendors began shipping 10GBase-T switches in the second quarter, but only three vendors total shipped more than 10,000 10GBase-T ports. It will be interesting to track the extent to which wider 10GBase-T deployment will prompt sales of 10G-capable Category 6A cabling systems. Because Category 6A has been widely available for close to a decade, some data center facilities may already be equipped with 6A cabling and waiting for the availability of affordable and energy-efficient 10GBase-T network gear.

Another data center perspective, this one from Infonetics, indicates that in the storage area network (SAN) 16-Gbit/sec Fibre Channel is set to surpass 8-Gbit/sec Fibre Channel (FC) by year's end. This trend may prompt some data center SANs to upgrade from Om2 fiber to Om3 or Om4. Om2 supports 8-Gbit/sec FC to 50 meters, and 16-Gbit/sec FC to 35 meters. Om3 supports 8- and 16-Gbit/sec FC to 150 and 100 meters, respectively; Om4 supports 8G FC to 190 meters and 16G FC to 125 meters. Cliff Grossner, Infonetics' directing analyst for data center and cloud, noted, "We're forecasting 16G Fibre Channel switch revenue to grow at a 46-percent compound annual growth rate from 2013 to 2017." Depending on the distances SAN administrators intend to reach with 16G, they may be in for some new multimode fiber-optic cabling.

Wireless, not cable-less?

Professionals in the structured cabling industry have experienced firsthand the realities that have prompted expressions such as, "Wireless, isn't," "wiring for wireless," and others that point out there are, in fact, cables behind wireless access points. The notion that WLANs will do away with cabling altogether is now by and large dismissed, however the possibility remains that pervasive WLANs will decrease but not eliminate the number of cables installed in an enterprise network's horizontal architecture.

Dell'Oro's enterprise-edge report mentioned WLANs taking market share away from enterprise switching equipment. When the enterprise-edge report was made available, Dell'Oro's DePuy said, "With new 802.11ac-compliant WLAN devices now shipping, enterprises are faced with the prospect of having to upgrade their cabling and campus Ethernet switches to satisfy the greater power and throughput requirements for these devices. Much of the installed base of Ethernet switches that are 802.3af-capable may not be adequate to service 802.11ac wireless. Newer switches have more power available, yet the throughput needs of 802.11ac may require multiple Gigabit Ethernet ports or even 10-Gigabit-per-second ports, which may drive additional in-building cabling. This is important because enterprises will be forced to develop specialized wiring and network systems that are separate from those previously shared with desktop wiring and switches, or else run 802.11ac at less-than-full capacity."

Based on this analysis, the prospect of WLAN taking market share from switching appears to be a longer-term projection. In the near term, 802.3at Power over Ethernet-capable switches will be in demand, as will cabling capable of supporting multi-gigabit transmission.

Infonetics also tracks the WLAN market, and in its recently completed Wireless LAN Strategies and Vendor Leadership: North American Enterprise Survey, the firm looked at how medium and large organizations are evolving their access networks to deliver wireless connectivity to users. Machowinski said, "Thanks to the explosion in wireless devices and demand for network access, WLAN is already a $4 billion annual market, and our latest survey shows there's no end in sight to the great big wireless LAN buildout. Organizations tell us they're planning major increases in wireless coverage, growing their access points by more than 20 percent by 2015 to support wireless devices, user mobility and guest access."

The other wireless

Infonetics also examines the market for distributed antenna systems (DAS), part of which includes privately owned in-building DAS. In October it completed a study titled DAS Equipment Market Outlook. The report covers DAS equipment units and revenue by geographic region and by category; categories are in-building, LTE, multi-standard and outdoor. Stephane Teral is Infonetics' principal analyst for mobile infrastructure and carrier economics. He commented, "DAS first became commercially viable in the late 1980s with the advent of optical fiber installed as a transport medium. Since then, the DAS business has been brisk with its lot of boom and bust, growing into a multi-billion-dollar market crowded with a flurry of vendor specialists.

"And contrary to all the hype and buzz surrounding small cells, the need for DAS is not going away anytime soon. In fact, most service providers have already included DAS as a key component of their future ‘small cell' mobile network expansion plans. With no signs of abating over the next five years, we believe global DAS revenue will grow at a CAGR of 3 percent from 2012 to 2017 and DAS node shipments will double—driven by a combination of coverage and capacity improvements in specific venues."

A highlight of the report's findings is that sports and entertainment stadiums make up the bulk of the DAS business. Infonetics considers these venues to be in-building or indoor DAS, noting that outdoor DAS is a niche market. Also, the United States and China are the world's largest DAS markets and Infonetics expects them to remain so through at least 2017 "due to the number and size of their stadiums, convention centers, and transportation stations and ports."

Infonetics pegs the total DAS market at $1.9 billion for 2012, a 4-percent revenue increase over 2011 and incorporating more than 1 million DAS nodes shipped in 2012. It credits CommScope as the revenue leader with 17 percent market share in 2012. Hong Kong-based Comba was the world's second-largest DAS equipment provider last year, Infonetics says.

The forces that push the cabling market—whether that push is forward or backward—certainly are varied, but benchmarks such as the computing operations within data centers and trends inside enterprise networks are indicators of the market's overall direction. Data and analysis from several research firms portend a time of active growth in the near-term, and sustained growth for years.

Patrick McLaughlin is our chief editor.

Archived CIM Issues